Assistant Accountant

(Level 3 Apprenticeship)

Who is this suitable for?

This could be someone progressing from the Level 2 Accounts/Finance Assistant Apprenticeship. Alternatively, it could be someone who only needs to complete the bookkeeping units of the Level 2 to gain a solid grasp of double entry bookkeeping before progressing to Level 3 units. They might be A Level school leavers or graduates with some accounting knowledge, or those with experience in an accounts function but no related qualifications.

An apprenticeship has to last a minimum of a year and a week and not everyone will want to spend a year completing Level 2.

The Apprenticeship Structure

The assessment of the Apprenticeship is by an End Point Assessment (EPA) that comprises:

- The Knowledge Assessment - an AAT computer based exam with 40 multiple choice questions

- A Professional Discussion/Structured Interview, performed by AAT Independent Assessors

Prior to sitting the EPA, apprentices muct have successfully completed the AAT Level 3 Diploma in Accounting.

Completion of the Level 3 Diploma in Accounting

Many of our apprentices in accounting practice need to achieve a solid grounding in double entry bookkeeping but don’t need to spend a year completing this via an apprenticeship. Instead, they will simply complete the two units from the Level 2 Certificate in Bookkeeping at the beginning of their Level 3 Apprenticeship, before progressing to the Level 3 Diploma in Accounting.

An apprenticeship must last at least 372 days and this fits in well with our normal timescales for the completion of the Diploma.

If the apprentice works less than 30 hours a week, the duration of the apprenticeship will need to be increased pro-rata.

If the prospective apprentice has no prior experience or knowledge in accounting or an accounting environment, they might need to complete the Level 2 Apprenticeship in order to provide the necessary underpinning knowledge to undertake the Level 3 units.

However, many of our apprentices simply need to achieve a better grounding in double entry bookkeeping – in which case they would only add the two units from the Level 2 to their Level 3 Apprenticeship.

60% of the End Point Assessment will relate to a “Professional Discussion” performed by an AAT Assessor. This will be based on a work experience portfolio and associated mapping document, recognising the high level of learning being undertaken at work. We will provide support throughout the apprenticeship on building this up:

Preparation for the Professional Discussion

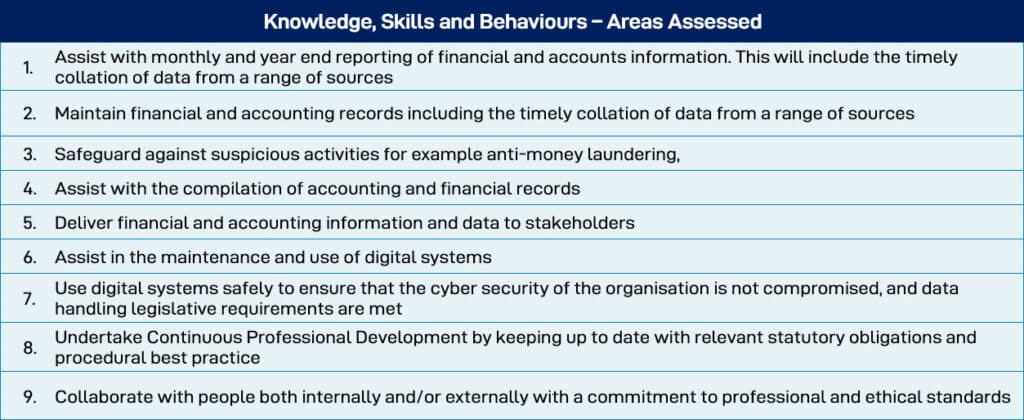

The Professional Discussion entails a one hour discussion with an AAT Independent Assessor. This will be performed remotely via the AAT’s online video portal. It is not a test, it is a method of assessing how much practical experience the apprentice has undertaken over their apprenticeship and covers the following Knowledge, Skills and Behaviours:

In order to support this discussion, apprentices will be required to prepare a Portfolio during their apprenticeship. This will consist of a series of Journals, reflecting on the development of these “significantly new skills and behaviours” and application of the related knowledge over the apprenticeship. These journals will be cross referenced to the detailed learning outcomes, and will be supported by workplace documents to evidence the achievement of those learning outcomes.

Apprentices must be provided a minimum of 6 hours per week from their paid hours for off-the-job-training. This used to be called “The 20% rule”.

Apprentices will need to maintain, and submit, a weekly log of OTJT so we can help you meet this requirement.

More detailed guidance on off the job training is provided elsewhere on this website https://apprenticeships.accountancylearning.co.uk/employers/apprenticeships/

Apprenticeship “Enhancements” – the real added value – seeing beyond the numbers

To support the development of the above Knowledge, Skills and Behaviours in the workplace, we have added further elements to our programme. These include providing access to a range of online learning materials designed to support the needs of the apprentice’s role and their workplace which assist in the development of their personal, leadership and management skills, helping them to become rounded accountants and not just technicians.

Footnote: If your prospective apprentice is likely to benefit from completing the full Level 2 Certificate in Accounting, do please liaise with us to see if the Level 2 Accounts Assistant Apprenticeship will be a more appropriate route to start off with.