Professional Accounting Technician

(Level 4 Apprenticeship)

Who is this suitable for?

The Professional Accounting Apprenticeship would be suitable for anyone progressing from the AAT Level 3 Assistant Accountant Apprenticeship, or anyone who already holds an equivalent qualification. It may also be relevant to those with extensive practical experience but no formal accounting qualifications.

Assessment

The assessment of the Apprenticeship is by an End Point Assessment (EPA) that comprises:

- The Synoptic exam from the AAT Level 4 Diploma in Accounting and

- A Professional Discussionor a Written Statement

Preparation for the Synoptic Exam

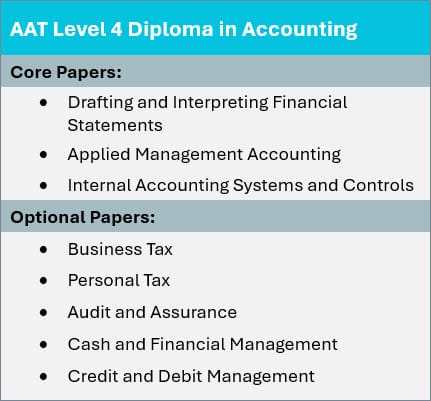

In order to successfully complete the Synoptic Exam, apprentices need to have a thorough understanding of the underpinning knowledge and this will normally be achieved by completion of the Level 4 Diploma in Accounting. This includes the following units which relate to the new Q2022 syllabus:

An apprenticeship must last at least 372 days and most learners will take at least this amount of time to complete the Diploma in Professional Accounting. If the apprentice works less than 30 hours a week, the duration of the apprenticeship will need to be increased pro-rata.

The optional units (shown opposite) are not tested in the Synoptic exam.

Although Internal Accounting Systems and Controls (INAC) is part of the Level 4 Diploma in Accounting, much of the topic is also covered in the Synoptic exam. The AAT have advised that Apprentices do not need to complete the INAC exam provided they successfully complete the Synoptic exam.

Optional units – students must complete 2 of the optional units to achieve the AAT qualification, but it may be useful for them to undertake more. For example by completing External Auditing students will be exempt from the ACA Assurance module, whilst undertaking Personal Tax and Business Tax will give them exemptions for the ACA Principles of Taxation module.

Preparation for the Professional Discussion / Written Statement

As with Level 3, the Professional Discussion entails a one hour discussion with an AAT Independent Assessor. This will be performed remotely via the AAT’s online video portal. This discussion is recorded and is subjected to a review by a second assessor, who will form their own assessment of the candidate’s competence.

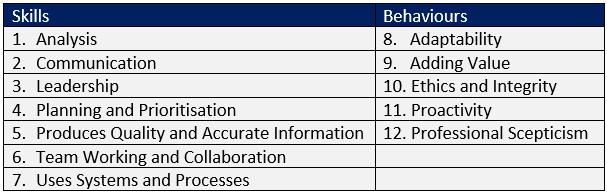

As an alternative to the Professional Discussion, apprentices can elect to submit a Written Statement of between 2,000 to 3,000 words. These are not tests, they are methods of assessing how much practical experience and competence the apprentice can evidence over their apprenticeship and they cover the following Skills and Behaviours:

Unlike Level 3, it will not be graded, it will simply be a ‘Pass’ or ‘Fail’.

In order to support this Professional Discussion/Written Statement, as with Level 3, apprentices will be required to prepare a Portfolio during their apprenticeship. This will consist of a series of Journals, reflecting on the development of these “significantly new skills and behaviours” and the application of the related knowledge over the apprenticeship.

These Journals will be cross-referenced to the detailed learning outcomes. The Portfolio will also contain examples of the work described in the Reflective Journals, suitably redacted, and to which they can be cross-referenced.

Off The Job Training requirement (OTJT)

Apprentices must be provided a minimum of 6 hours per week from their paid hours for off-the-job training. This used to be called ‘The 20% rule”. Apprentices will need to maintain, and submit, a weekly log of OTJT so we can help you meet this requirement.

OTJT can be achieved in a variety of ways – for detailed guidance on how you can achieve this requirement with the minimum amount of disruption, please contact us.

Apprenticeship “Enhancements” – the real added value – helping to turn a technician into a rounded professional

To support the development of the above Knowledge, Skills and Behaviours in the workplace, we have added further elements to our programme. These include providing access to a range of online learning materials designed to support the needs of the apprentice’s role and their workplace and which assist in the development of their personal, leadership and management skills, helping them to become rounded accountants and not just technicians.